EXR completes flow test, not what we were hoping for

That wasn't the result we were hoping for…

Elixir Energy (ASX: EXR) just released results from the final stage of flow testing at its QLD gas project.

Before today’s announcement, EXR had managed to show that the well was flowing at a stabilised 2.5 MMSCF per day from just one reservoir.

The idea was that EXR would stimulate and test the remaining five reservoirs (six in total) and increase that flow rate even more.

Unfortunately, EXR delivered a flow rate that was lower than the first set of results - 1 MMSCF per day.

So the flow rate numbers went backwards - which explains the market reaction today.

EXR’s share price ended the day down 58%.

How did EXR perform relative to our pre-flow test expectations?

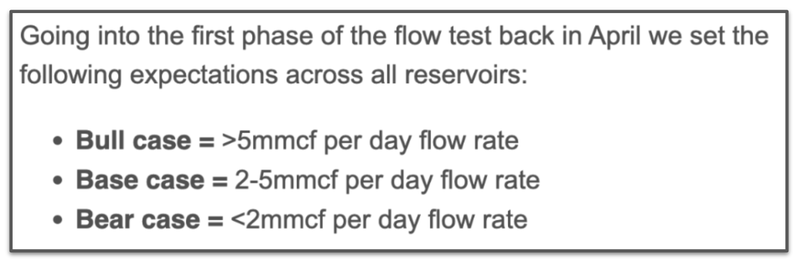

Going into the flow testing program, we set the following expectations for EXR:

After the first phase EXR flowed 2.5mmcf per day and hit our “base case” expectation.

With only one of the reservoirs tested in that first phase, we thought the company could multiply its flow test after all of the reservoirs were tested together.

We covered those results in a previous note here: EXR delivers commercial gas flow rates - 5 more zones still to be tested

That first result was from just one of the six reservoirs EXR had planned to test with this flow test.

As a result, we thought there was a good chance EXR could upgrade its overall flow rate after the second stage of testing was finished.

We expected an upgrade but instead got a surprise downgrade…

EXR’s final results were:

- A MAX flow rate of 2.6 MMSCF per day - this would have put EXR’s result into our “base case” scenario.

- A stabilised flow rate of 1 MMSCF per day - this puts EXR’s final results into the “bear case” scenario.

This hit our “bear” case scenario and the market movements today reflected this.

Did the market overreact to the news?

We were expecting a sell off this morning… But was the stock oversold?

This has been a 12-month long appraisal program for EXR and the company has learned a lot of new information through its drilling campaign.

The project has been advanced and EXR is in a more informed position compared to 12 months ago.

During drilling and flow testing at Daydream-2 EXR has managed to take the asset a long way forward…

EXR managed to:

- Increase the 2C contingent resource by 328% to 1.47 trillion cubic feet of gas

- Increase the overall prospective resource by 180% to 3.6 trillion cubic feet of gas.

- Flowing gas from five out of six stimulated zones and achieving what the company considers a commercial flow rate.

Let’s take a look at each of these in a bit more detail.

Increase the 2C contingent resource by 328% to 1.47 trillion cubic feet of gas

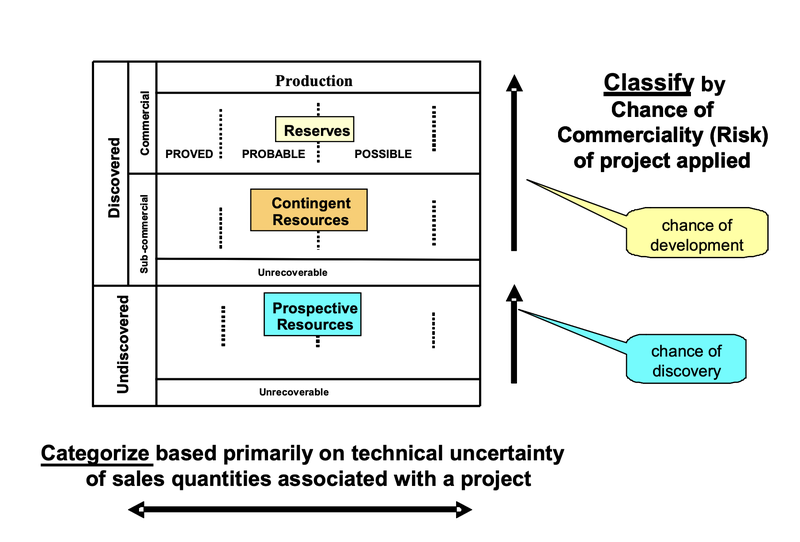

EXR has taken resources out of the prospective category and into a higher confidence “contingent category”.

This is good progress, especially considering this is the sort of data a major farm-in partner would look at when considering doing a deal with a small cap like EXR.

Increase the overall prospective resource by 180% to 3.6 trillion cubic feet of gas.

This is something that we think a major farm-in partner would be taking a look at.

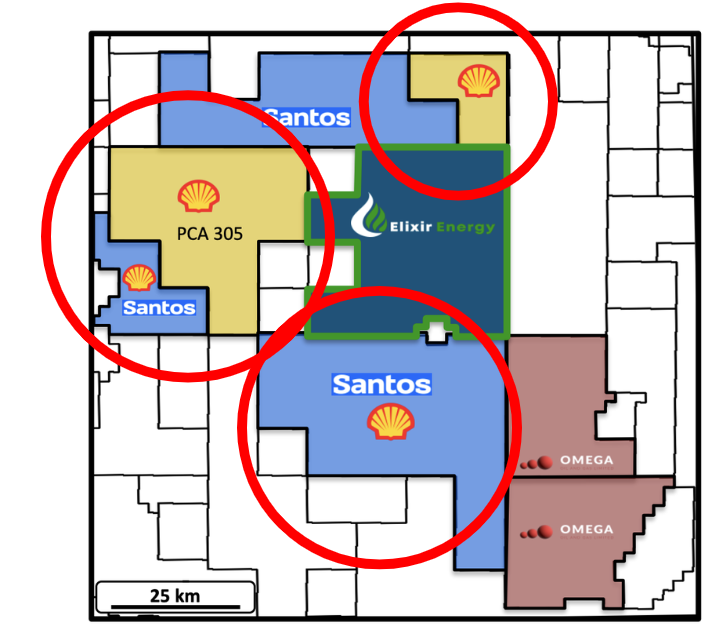

EXR’s project is right in the heart of the Taroom Trough next to major players like Santos and Shell, as well as Omega:

Increasing the prospective resource is something that we think a major farm-in partner would look at when deciding whether or not the upside would be worth farming into.

EXR has flagged in the past the possibility of a large player coming to farm-into the project, so it is a “watch this space” from our end.

Flowing gas from five out of six stimulated zones and achieving what the company considers a commercial flow rate.

This is important technical data that de-risks the project from an exploration perspective.

Again, we think that this is the type of information that a major farm-in partner could look at in a data room and figure out whether or not they can bring a different approach/expertise to unlock higher flow rates.

All things considered, we knew the market reaction would be negative.

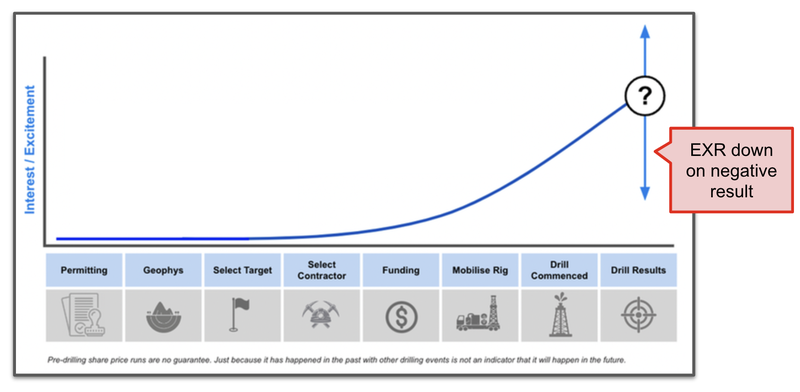

The EXR share price had gone from ~6c in the middle of 2023 to a high of ~20c a few weeks ago.

At its peak EXR’s market cap was knocking on the door of ~$200M.

At those levels, there was a lot of expectation built into EXR’s share price - so a lot of things had to go right and the company had very little margin for error.

With technically difficult things like flow tests, it's rare that nothing ever goes wrong and company’s deliver results way above their expectations.

Our view is that today’s market reaction is simply a case of a stock pricing in blue sky results and the company delivering results way below that expectation.

Now, EXR’s share price is trading near where it was in the middle of last year, meaning that the market is not pricing in any of the progress over the last 12-months despite all of the progress made at the project level.

We will be watching the EXR share price over the next few days to see where it settles…

What’s next for EXR?

Daydream- 3 preparation 🔄

It was nice to see EXR already thinking about Daydream-3.

At this stage it's too early for us to speculate on what Daydream-3 would look like but it will be interesting to see how EXR chooses to progress the project.

EXR’s MD Neil Young mentioned in today’s announcement, “We expect our discussions with potential partners will now likely be accelerated”. We think whatever comes from those discussions will ultimately form the basis for the size/scale of the next program.